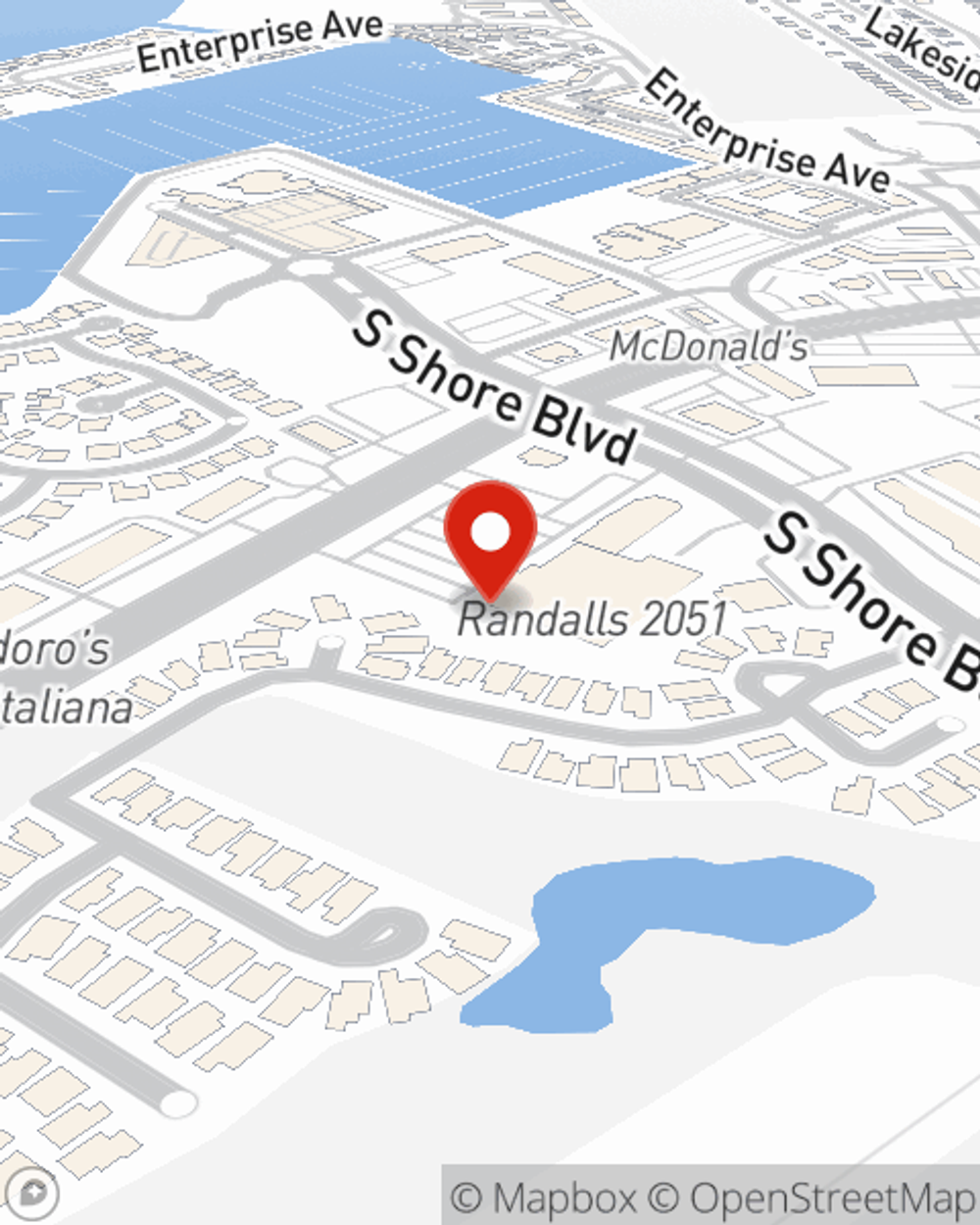

Insurance in and around League City

Protect the life you've built

Insurance that works for you

Would you like to create a personalized quote?

- League City

- Clear Lake

- Seabrook

- Dickinson

- Webster

- Friendswood

- Pearland

- Santa Fe

- Texas City

- Manvel

- Kemah

- Clear Lake Shores

Personal Price Plans To Fit Your Needs

Your loved ones and your things are some of what's most important to you. It's understandable to want to protect them. That's why State Farm offers terrific insurance where you can build a Personalized Price Plan to help fit your needs.

Protect the life you've built

Insurance that works for you

Protect Your Family, Vehicles, Home, And Future

But your car or truck is just one of the many insurance products where State Farm and Tyler Landry can help. Do you operate a business in the League City area or want to be your own boss? Navigating the complicated world of small business insurance? Tyler Landry can make it easy to find the insurance you need to protect what you’ve worked so hard to achieve. And we also offer a number of liability insurance options to guard the ones you love in the event of an illness or injury.

Simple Insights®

How much car insurance do I need?

How much car insurance do I need?

Learn about coverages, deductibles, limits, liability and more to help decide how much auto insurance you need and how you can save.

What is first party medical and PIP coverage?

What is first party medical and PIP coverage?

Personal Injury Protection (PIP) pays the reasonable and necessary medical expenses you and your passengers incur after an accident, regardless of fault.

Tyler Landry

State Farm® Insurance AgentSimple Insights®

How much car insurance do I need?

How much car insurance do I need?

Learn about coverages, deductibles, limits, liability and more to help decide how much auto insurance you need and how you can save.

What is first party medical and PIP coverage?

What is first party medical and PIP coverage?

Personal Injury Protection (PIP) pays the reasonable and necessary medical expenses you and your passengers incur after an accident, regardless of fault.