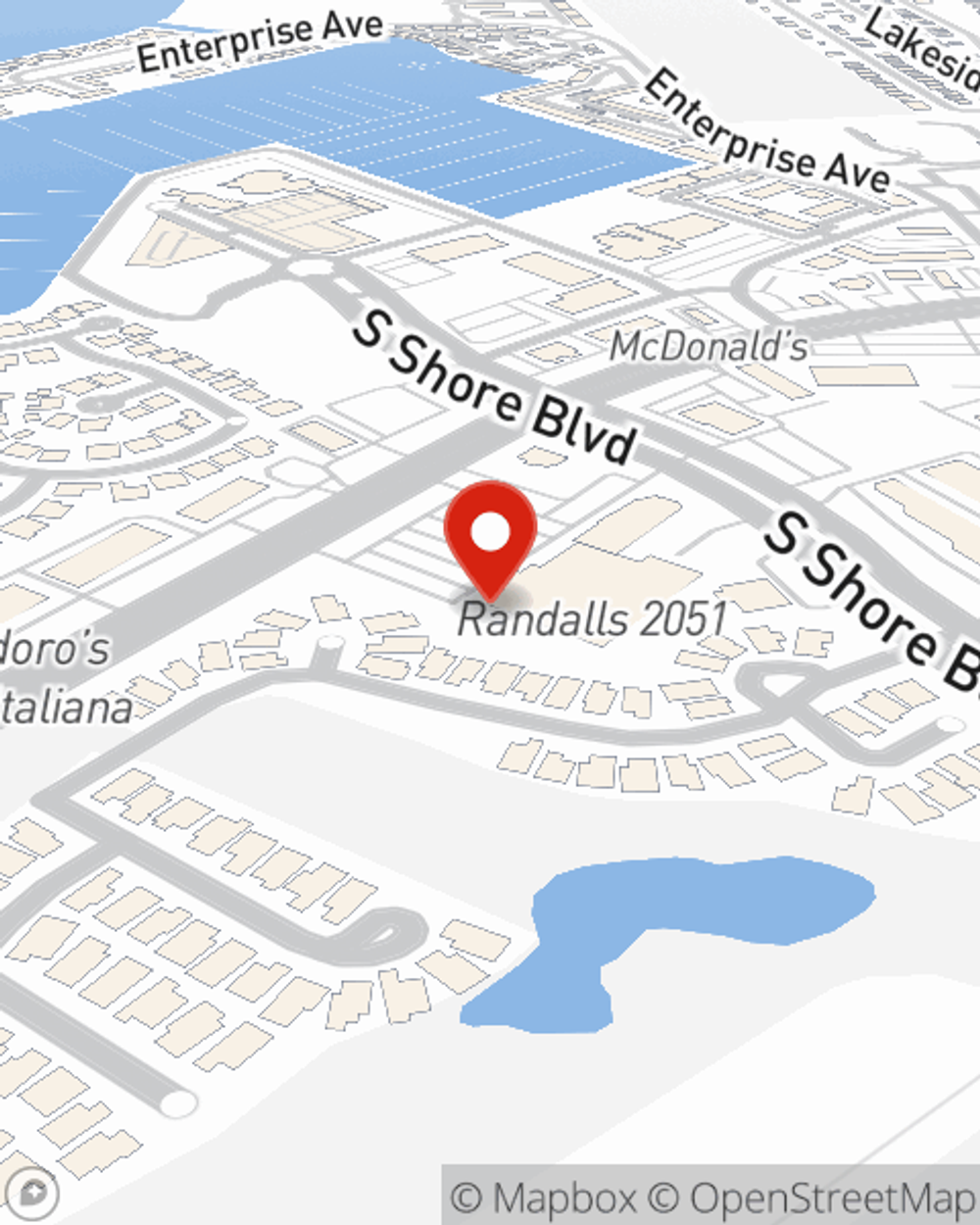

Condo Insurance in and around League City

Townhome owners of League City, State Farm has you covered.

Cover your home, wisely

- League City

- Clear Lake

- Seabrook

- Dickinson

- Webster

- Friendswood

- Pearland

- Santa Fe

- Texas City

- Manvel

- Kemah

- Clear Lake Shores

Your Stuff Needs Insurance—and So Does Your Condo Unit.

When you think of "home", your condo is first to come to mind. That's your sanctuary, where you have made and are still making memories with family and friends. It doesn't matter what you're doing - recharging, playing, cooking - your condo is your space.

Townhome owners of League City, State Farm has you covered.

Cover your home, wisely

Protect Your Home Sweet Home

We understand. That's why State Farm offers wonderful Condo Unitowners Insurance that can help protect both your unit and the personal property inside. Agent Tyler Landry is here to help you understand your options - including benefits, savings, bundling - helping you create a customizable plan that works for you.

Ready to move forward? Agent Tyler Landry is also ready to help you see what customizable condo insurance options work well for you. Visit today!

Have More Questions About Condo Unitowners Insurance?

Call Tyler at (281) 334-2486 or visit our FAQ page.

Simple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Tyler Landry

State Farm® Insurance AgentSimple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.